Over the years, I’ve had a lot of conversations with employees who feel like saving money is impossible. They look at their paychecks and living expenses and think there’s just no way to set anything aside. I understand that feeling, because it’s easy to assume you need to make a lot more money before you can start saving.

But what I’ve seen again and again is that you don’t have to wait for some big jump in income to build the habit. It can start with something small, so small you won’t even miss it (I Promise). Over time, that small step can turn into a meaningful safety net or a head start on bigger goals.

I want to share the approach I’ve recommended to a lot of people I work with. It’s simple, automatic, and it doesn’t require you to overhaul your lifestyle overnight. This method has worked for employees making all kinds of incomes, and it can work for you too.

The Mental Shift

One of the biggest obstacles to saving isn’t the math. It’s the mindset. A lot of people feel like if they can’t save hundreds of dollars every month, it’s not even worth trying. That belief keeps them from starting at all.

The truth is, saving doesn’t have to be about making huge sacrifices or living like you’re broke. It can be about taking small steps that build momentum over time. Even a tiny amount set aside consistently can add up faster than you expect.

What I’ve seen with employees is that once they realize they can save a little without feeling it, they start to see saving as something possible. That mental shift is usually the hardest part. After that, it becomes a habit that runs quietly in the background of their life.

Why a Separate High-Yield Account Helps

.One of the most effective things you can do is open a separate savings account that isn’t connected to your everyday spending. I usually recommend a high-yield online account like Ally because it pays better interest than a regular bank and is easy to set up. Other good options include CIT Bank, SoFi, and Marcus by Goldman Sachs. Most of these accounts have no monthly fees and can be opened entirely online.

The next step is the most important: setting up direct deposit with your employer so a small percentage (we’ll go into more about this in the next section) of every paycheck goes straight into this account. A lot of people think this part will be complicated, but most payroll systems let you split your deposit into multiple accounts with just a simple form or an online request. In my experience, it usually takes less than five minutes to get it done. Any manager who cares even a little bit about their employees will guide you through this process. If you work for a company with an HR department, reach out to them and ask for a direct deposit form.

Having your savings in a separate place makes it much less tempting to spend. When the money doesn’t land in your main checking account, it feels like it isn’t even there. That separation is what helps most people actually leave the money alone and let it grow.

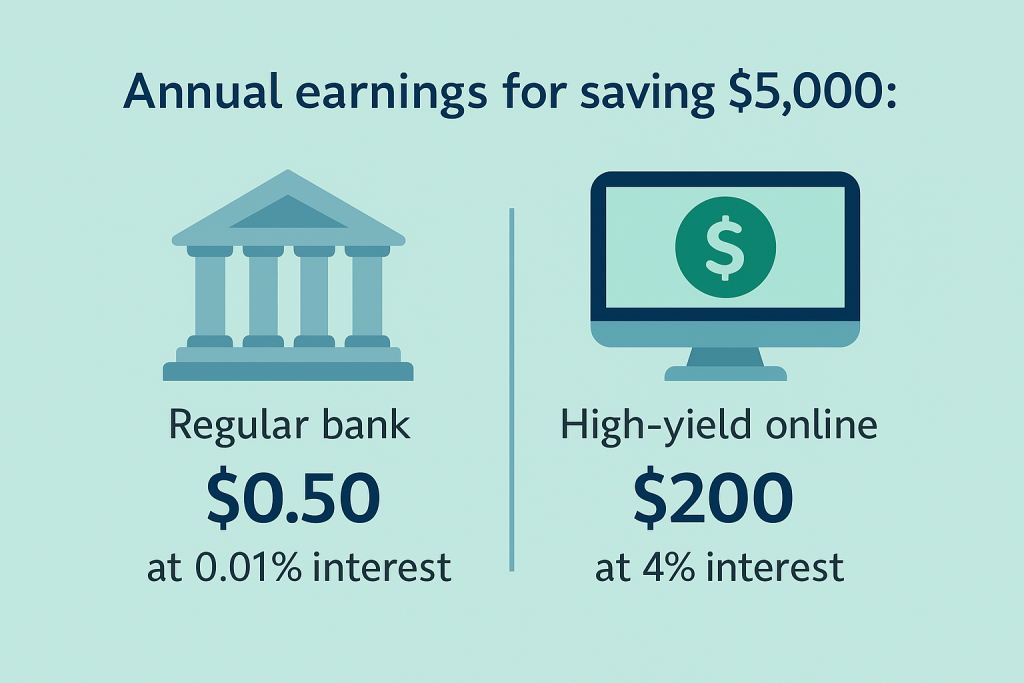

It also makes a big difference over time. Many regular bank savings accounts pay around 0.01% interest. That means if you save $5,000 for a year, you’d earn about fifty cents. By comparison, a high-yield online savings account paying 4% or more could earn over $200 in the same time. That gap adds up year after year, especially when you’re saving automatically.

When you set this up, you’ll start to see your balance growing in the background, without having to think about it. For a lot of people, this simple system is what finally helps them break the cycle of believing they can’t save.

The 2% Rule

When I talk to employees about saving, most of them say the same thing: “I don’t have enough left over at the end of the month.” That’s why I suggest starting with something so small it doesn’t feel like a loss. For a lot of people, that number is 2%.

The idea is simple. If you get paid $1,000, you send $20 straight into your high-yield savings account through direct deposit. Almost everyone can adjust their spending to live without that 2%, especially if they never see it in their main checking account. Over time, those small amounts start to grow into something real.

Obviously, if you think you can stretch to 3% or 4% to start, all the better. The more you can set aside early, the faster you will see progress.

To give a real-world example, I once worked with a young lady who was living at home with her parents while working full time. She was in a fortunate spot because her basic living costs were low. When we sat down and went through her expenses, including money she wanted to spend eating out and buying Pokémon cards, she realized she could comfortably save about 50% of her paycheck. By the end of her first year, she had put away $10,000.

Not everyone will be in a situation like that, and that’s okay. Some people have rent, family expenses, or other obligations that make it harder to save large amounts. The point is to look honestly at your own situation and figure out what percentage you can live without. Whether that number is 2% or something much higher, the important thing is to set it up and start. Over time, you will be glad you did.

This system works because it removes friction. You don’t have to think about whether you are going to save each month. The decision is already made, and the money moves automatically. Over time, it builds a habit, and habits are what create real change.

Final Thoughts

Saving money doesn’t have to be complicated or overwhelming. It also doesn’t have to mean giving up everything you enjoy. The most important thing is to start somewhere and keep it consistent.

If you can set up a separate high-yield account and start with even a small percentage of each paycheck, you’ll be taking a real step toward building a safety net for yourself. Over time, those small deposits can add up to something you will be proud of.

Remember that everyone’s situation is different. Some people can save a lot right away, and others will need to start smaller. The important thing is to do what works for you and stick with it. A few years from now, you’ll be glad you made the choice to set it on autopilot and let your savings grow in the background.

If you found this helpful or have any questions about getting started, feel free to explore the other articles here or reach out. I’m always happy to share ideas and help people get moving in the right direction.

🎯 Ready to start building passive income?