When I first thought about investing, it felt completely out of reach. Buying stocks, picking funds, or just understanding how it all worked seemed confusing and intimidating. I assumed it would take thousands of dollars just to get started.

Acorns was the first tool that changed that mindset for me. I opened my account about eight years ago with nothing more than a small recurring deposit of ten dollars per month. This was an amount I knew I could easily manage. I also turned on their Round-Ups feature, which automatically rounds up my purchases to the nearest dollar and invests the spare change. It was not much, maybe only an additional eight to ten dollars a month, but over time, those small amounts added up more than I expected.

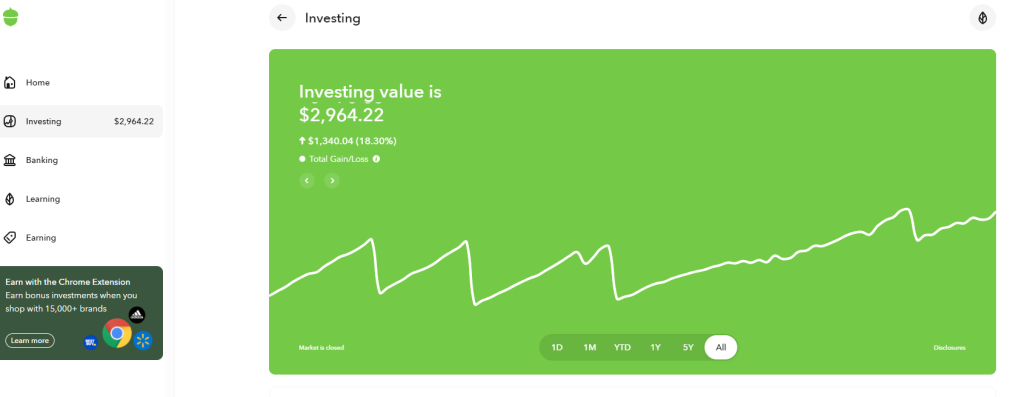

Today, my Acorns account has grown to almost three thousand dollars, and that is after I withdrew over eighteen hundred along the way to pay for other goals. I have kept my portfolio set to Moderately Aggressive, with about eighty percent invested in stocks and twenty percent in bonds. Acorns makes it simple because they invest for you automatically, including buying fractional shares of different investments based on your chosen risk level.

If you are someone who thinks investing is too complicated or that you do not have enough money to start, I promise you this approach can help you build momentum without feeling overwhelming.

If you decide you want to try Acorns, you can use my referral link here to get started. If it says “Join David,” then you are in the right place and you will receive a five dollar bonus once you invest your first five dollars.

How Acorns Works

Acorns is what people call a micro-investing app. It takes the money you set aside, whether it is small recurring deposits or spare change, and invests it automatically into a diversified portfolio.

When you sign up, Acorns asks a few questions about your goals and comfort level with risk. Based on your answers, it recommends a portfolio that ranges from Conservative to Aggressive. Each portfolio is a mix of exchange-traded funds, also known as ETFs, which are baskets of stocks and bonds.

One thing I appreciated right away was that you do not need to pick individual stocks or try to time the market. Acorns handles all of that behind the scenes.

Another feature that makes it beginner-friendly is fractional shares. Instead of needing hundreds of dollars to buy a full share of a company, Acorns buys small pieces of many investments. This way, even if you invest just a few dollars at a time, you still get exposure to a broad range of companies and bonds.

Acorns charges a simple monthly fee, which depends on the plan you pick. For most people just getting started, the basic Personal plan is all you need. It costs about three dollars a month, which is a small price compared to what you can potentially gain over time.

Between the recurring deposits and the Round-Ups feature, you can build an investing habit without thinking much about it. That is what made it so appealing to me when I was first starting out.

You can open your account here, which helps support this site at no extra cost to you. If it says “Join David,” you are in the right place and you will get a five dollar bonus once you invest your first five dollars.

Benefits and Limitations

Like any financial tool, Acorns has strengths and drawbacks. I think it is important to know both before you decide if it is right for you.

Benefits:

- Easy to Start: You can open an account in just a few minutes without needing any investing experience.

- Automatic Investing: Acorns takes care of choosing and managing your investments so you do not have to spend time researching stocks or funds.

- Fractional Shares: Even small deposits are invested across many companies, which helps you build a diversified portfolio.

- Round-Ups: The spare change feature helps you save and invest extra money without feeling it.

- Goal-Oriented: You can set goals in the app to stay motivated and track your progress.

Limitations:

- Monthly Fee: Acorns charges about three dollars per month for the basic plan. If you have a very small balance, this fee can take a noticeable chunk of your gains. If you can start with at least five hundred dollars, it helps offset the fee faster.

- Limited Control: You cannot pick individual stocks or build your own custom portfolio. Some people prefer more flexibility.

- Market Risk: Your investments can go up and down in value. This is true of any stock-based investment, but it is worth keeping in mind so you are not surprised by short-term changes.

- No Tax-Advantaged Accounts by Default: The standard Acorns account is taxable. They do offer IRAs through Acorns Later, but you have to sign up for a higher-tier plan. We will get to setting up an IRA in the future once you have built some savings and feel ready for that next step.

How to Get Started with Acorns

If you are ready to give Acorns a try, here is a simple way to get started without feeling overwhelmed.

1. Download the App or Visit the Website

If you are ready to take the first step, click here to start your Acorns account. It only takes a few minutes to set up and you will be on your way to building your investments automatically.

2. Answer a Few Questions

Acorns will ask about your age, goals, income, and comfort level with risk. These questions help them recommend the right portfolio for you.

3. Link Your Bank Account

You will connect your checking account so Acorns can move money and track your spending for Round-Ups.

4. Choose Your Recurring Deposit

Start with an amount you know you can afford. Even ten or twenty dollars a month is a good first step. You can always adjust it later.

5. Turn on Round-Ups

If you want to invest spare change, enable the Round-Ups feature. Every time you make a purchase, Acorns will round up to the next dollar and set aside the difference.

6. Pick Your Portfolio

Review the recommended portfolio and adjust it if you prefer a different risk level. You can choose Conservative, Moderately Conservative, Moderate, Moderately Aggressive, or Aggressive. Generally, the younger you are, the more aggressive you may want to be.

7. Let It Run

Once you set everything up, the best thing you can do is leave it alone. Keep your recurring deposits going and check in once in a while to see your progress.

Final Thoughts

Starting small is the most important part. You do not need to have it all figured out on day one. Even a few dollars invested each week can build real momentum over time. Acorns helped me get past the idea that investing was only for wealthy people or financial experts. It showed me that consistency matters more than perfection.

If you are ready to take that first step toward building your future, click here to start your Acorns account. You will get a five dollar bonus when you invest your first five dollars, and you will start a habit that can grow into something meaningful.

🎯 Ready to start building passive income?